As of January 8, 2026, NVIDIA (NASDAQ: NVDA) has solidified its position as a dominant force in the global economy, recently surpassing a historic $5 trillion market capitalization. This remarkable ascent marks the company’s evolution from a specialized semiconductor designer to a central player in the burgeoning “Intelligence Age.” Amidst widespread scrutiny and acclaim, NVIDIA’s unparalleled command over the Artificial Intelligence (AI) chip market is a testament to its strategic foresight and operational prowess. This analysis delves into the key factors driving NVIDIA’s extraordinary growth, its current market strength, and the challenges that lie ahead as it strives to maintain its leading status.

Founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem, NVIDIA’s vision began with revolutionizing 3D graphics for gaming and multimedia. The company established itself as a formidable competitor with the launch of the RIVA TNT, but it was the introduction of the GeForce 256 in 1999, touted as the world’s first “GPU,” that truly defined its trajectory. Over the years, NVIDIA navigated through economic downturns, including the dot-com bust and the 2008 financial crisis, by continually pivoting its business model. A pivotal moment came in 2006 with the release of CUDA (Compute Unified Device Architecture), allowing researchers to leverage GPUs for general-purpose computing, paving the way for the deep learning boom that would follow.

NVIDIA’s business model has transformed significantly, shifting from merely selling discrete hardware to offering comprehensive “rack-scale” systems. Currently, the Data Center division, often referred to as the “AI Factory,” accounts for approximately 90% of the company’s revenue, driven by products like the H100, Blackwell (B200), and the upcoming Rubin (R100) GPUs, all integrated with high-speed networking technologies. While gaming remains a secondary yet profitable segment, bolstered by AI-enhanced graphics via the GeForce RTX line, the Professional Visualization and Automotive sectors are also high-growth areas, focusing on applications such as digital twins and autonomous vehicles.

The financial metrics for NVIDIA are striking. Forecasts for the fiscal year 2026 suggest revenue could reach between $170 billion and $207 billion, a dramatic increase from just $60.9 billion reported two years ago. Profit margins have stabilized impressively between 50% to 55%, with gross margins exceeding 70%. The company generates substantial free cash flow, which is being utilized for aggressive share buybacks and increased dividends, maintaining high liquidity in the market. Despite its massive market cap, NVIDIA’s Forward P/E ratio remains competitive, trading in the range of 30x to 40x, reflecting strong earnings growth congruent with its share price appreciation.

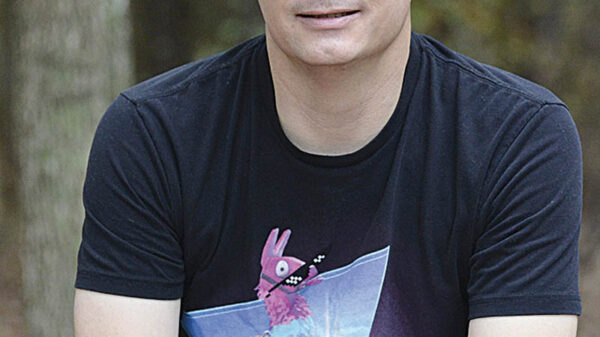

The leadership at NVIDIA plays a critical role in its sustained success. Co-founder and CEO Jensen Huang is recognized as one of the most effective tech executives, fostering a corporate culture characterized by “intellectual honesty” and rapid execution. Under his guidance, the management team, including CFO Colette Kress, has overseen NVIDIA’s transition into a financial powerhouse, significantly compressing product release cycles from two years to just one. Innovations such as the Blackwell architecture and the anticipated Rubin systems are central to NVIDIA’s ongoing technological leadership.

Market Challenges and Competitive Landscape

While NVIDIA commands over 90% of the AI data center market, competition is intensifying. Advanced Micro Devices (NASDAQ: AMD) has gained traction with its MI450X series, positioning itself as a viable alternative for large cloud providers. Additionally, major companies like Alphabet (NASDAQ: GOOGL) and Amazon (NASDAQ: AMZN) are increasingly developing their own internal chips to mitigate reliance on NVIDIA. Emerging startups, including Groq and Cerebras, are also targeting niche markets, focusing on latency and specialized task efficiency. Despite these challenges, NVIDIA’s integrated approach combining hardware, software, and networking remains difficult for competitors to replicate.

Geopolitical factors pose another layer of complexity for NVIDIA. Export controls on high-end AI chips to China have necessitated the development of specialized, lower-performance versions of its products. Recent U.S. policy changes have introduced revenue-sharing fees on certain high-tech exports, complicating international sales. Furthermore, antitrust scrutiny from regulators in the U.S. and EU has also raised concerns regarding NVIDIA’s market dominance and sales practices, requiring vigilance as the company navigates this intricate landscape.

As NVIDIA enters 2026, it stands at the forefront of a technological revolution. The transition from a component manufacturer to a provider of “AI Factories” positions it favorably within the most significant capital expenditure cycle in history. Although competition from custom silicon and AMD is rising, and geopolitical tensions present ongoing risks, NVIDIA’s commitment to relentless innovation, exemplified by its upcoming Rubin architecture, ensures that it remains several steps ahead. For investors, NVIDIA continues to represent a unique opportunity in the evolving AI landscape, combining the potential for hyper-growth with institutional-grade stability. Meeting supply chain challenges and managing power constraints will be crucial as the company strives to sustain its remarkable expansion.