November 2025 saw a significant decline in physical video game and hardware sales in the United States, marking the lowest figures reported since November 1995. According to the latest Circana report, released by executive director Mat Piscatella, total consumer spending on video games, hardware, and accessories reached $5.9 billion, a 4% decrease compared to the same month last year. This downturn raises questions about consumer behavior amidst rising costs.

Hardware spending, in particular, plummeted to $695 million, reflecting a staggering 27% drop from November 2024. This figure positions November 2025 as the second-lowest month for hardware spending since November 2005, with only $455 million recorded. In terms of unit sales, hardware units sold fell to 1.6 million, a figure not seen since 1995 when sales dipped to 1.4 million units. A closer look at specific console sales reveals that Xbox Series X/S consoles experienced a steep 70% decline compared to the previous year, while PlayStation 5 sales were down by 40%. The Nintendo Switch also saw a decrease, albeit a more modest 10%, despite the availability of the Switch 2.

Accessory sales mirrored this downward trend, totaling $327 million, which represents a 13% drop compared to November 2024. Spending on controllers alone dropped by 19%. Interestingly, the only category that saw an uptick was content sales, encompassing video games and downloadable content, which grew by 1%. However, physical game sales were down 14% year-over-year, marking another “all-time low for a November month since tracking began in 1995,” according to Piscatella.

The underlying reasons for this decline in sales appear to be multifaceted. Piscatella highlighted that the soaring costs of essential goods are squeezing consumer budgets, leaving less disposable income for discretionary spending on video games. “Retail spending had been holding up relatively well until now, despite the pressure from higher prices we’ve been seeing in the market,” he commented. The affluent segments of consumers had maintained spending, but it seems that the increase in prices for gaming hardware may finally be taking its toll. Piscatella emphasized that continued increases in RAM prices could lead to more severe repercussions for dedicated gaming devices, impacting both hardware and game sales.

Earlier in the year, Piscatella indicated the potential for rising living costs to affect the gaming market. As consumers face escalating prices for necessities, their ability to invest in gaming may diminish, especially as the average console price in the U.S. has surged to $439 from $239 in November 2019. This increase suggests that even older generation consoles are now pricier, further limiting access for many buyers.

While November’s figures could represent an isolated downturn, the ongoing trend of rising costs raises concerns about the sustainability of the gaming market in the near future. The impact of memory shortages and other industry-wide challenges may result in continued price instability, leaving many consumers priced out of purchasing the latest technology. Unless wage growth keeps pace with rising costs, the trend of declining hardware and accessory sales could become a more persistent issue.

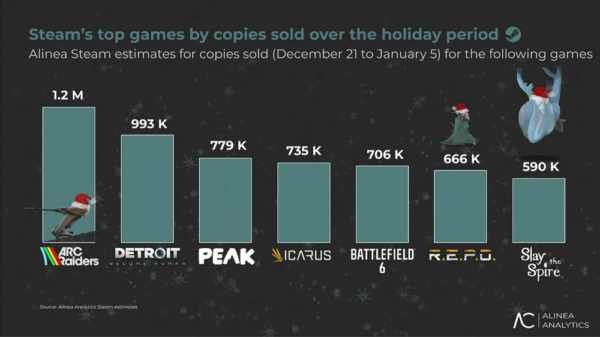

On the gaming front, November 2025 did provide some noteworthy insights. Call of Duty: Black Ops 7 emerged as the best-selling game for the month, although it failed to make the top five in year-to-date sales, where Battlefield 6 continues to dominate both monthly and yearly charts. The sustained success of Battlefield 6, now the second-best-selling game for November, suggests a possible shift in consumer preferences within the first-person shooter genre. As the year progresses, it remains to be seen whether Battlefield 6 will outpace Call of Duty in overall sales by year-end.

As the industry grapples with these trends, stakeholders will be watching closely to assess the implications for future releases and overall market health. The coming months will be critical in determining whether November’s figures signify a deeper trend or merely a temporary setback.