India is poised to become a major player in the global gaming market, as highlighted in a recent report from Niko Partners. By 2025, the country is projected to have approximately 500 million gamers, making it the fastest-growing gaming market across Asia and the MENA regions. This growth has been driven by a surge in player numbers, heightened engagement, and increased spending on in-game purchases—excluding the previously influential segment of real money gaming.

Player spending on games is anticipated to exceed $1 billion by 2025, indicating a significant shift towards monetization across a diverse array of titles and genres. Central to this expansion is mobile gaming, which remains the dominant platform in India. According to the report, around 95% of Indian gamers utilize smartphones for gaming, highlighting the essential role of mobile devices in both casual gameplay and competitive experiences. The affordability of these devices, coupled with widespread mobile data access, continues to shape the landscape of game development and distribution in the region, compelling publishers to adopt mobile-first strategies.

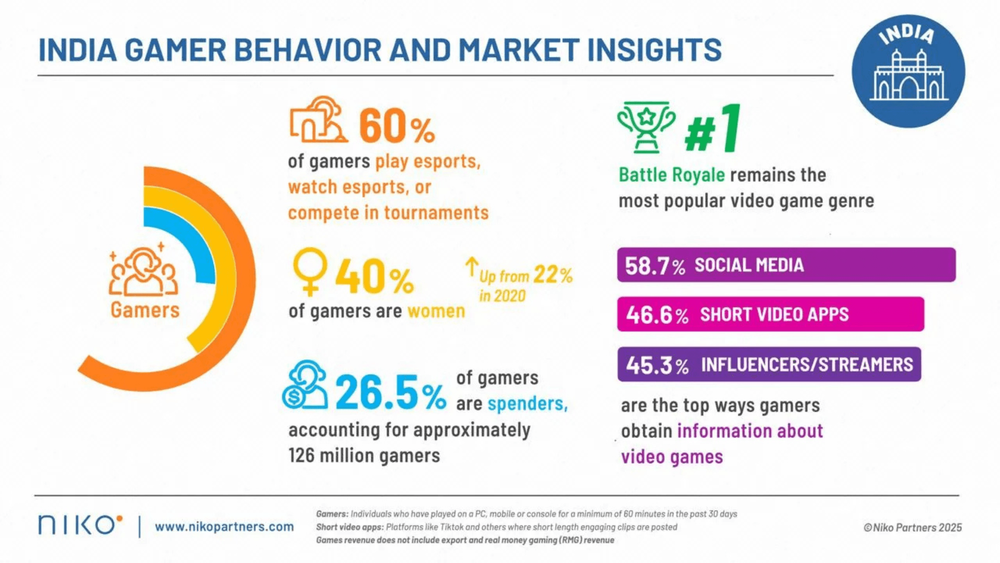

This focus on mobile has also redefined content formats, session lengths, and monetization models, which are increasingly tailored to suit the quick, frequent play sessions typical of mobile users. Alongside this, the demographic composition of India’s gaming audience is evolving. Women now constitute 40% of gamers, a marked increase from 22% in 2020. This shift underscores a broader cultural acceptance of gaming, signaling a more diverse audience engaging with various genres across multiple platforms.

As the player base expands, developers are seizing new opportunities to cater to a wide range of preferences, themes, and social play styles, particularly within mobile and online multiplayer titles. Esports engagement is also witnessing significant growth, with 60% of Indian gamers interacting with the esports ecosystem—whether by playing competitive games, watching tournaments, or participating in organized events. This level of interaction highlights esports’ transition into a mainstream facet of gaming culture in India, rather than a niche interest.

Among the various genres, Battle Royale games continue to capture the imagination of Indian gamers. Approximately 40% of surveyed players indicated they expect to play Battle Royale titles in the coming year, underscoring the genre’s enduring influence on player habits and content trends. The rise of mobile gaming and the increasing engagement in esports are contributing to a vibrant gaming culture that is rapidly gaining momentum.

In terms of game discovery, digital platforms play a crucial role. Social media channels are the most common avenues for players to learn about new titles, followed closely by short-form video apps. Streamers and influencers are becoming increasingly important, reflecting a shift toward creator-led promotion in the Indian gaming market. These patterns are reshaping marketing strategies, as publishers increasingly rely on community engagement and collaborations with content creators rather than traditional advertising methods.

Despite the massive player base, monetization is still in its developmental stage. The report notes that about 26.5% of gamers in India spend money on games, translating to roughly 126 million paying players. This figure not only highlights the current revenue landscape but also points to considerable long-term growth potential as payment systems, pricing strategies, and localized content continue to improve. Looking ahead, Niko Partners forecasts that the Indian gaming market will reach $1.5 billion by the end of 2028, with the total number of gamers expected to swell to 724 million by 2029.

With mobile adoption on the rise, increased visibility of esports, and a diversifying demographic, India is set to remain a focal point for the global gaming industry. As these trends unfold, the country’s gaming landscape is likely to evolve, presenting new opportunities for both developers and players alike.